Weekly Insights. February 7, 2026

Best hospitality industry articles focused on 💵revenue, 📊markets, and 🎯strategy (Feb 1 - Feb 7, 2026)

ALIS 2026 takeaways: A hotel investment landscape defined by liquidity, caution, and a race for differentiation

HVS’s ALIS 2026 recap says the hotel investment landscape is defined by plenty of capital but few deals, with owners and lenders staying cautious as labor, regulation, insurance, and debt costs keep margins tight. Luxury continues to outperform midscale and economy, travel demand is decoupling from broader GDP signals, and investors are prioritizing NOI quality, operational efficiency, and clear differentiation through brand and product. The near-term playbook favors conversions and selective development over volume, with disciplined underwriting and data driven execution guiding decisions.

Are chatbots the new social media?

7B visits in a single month, a growth line that echoes the primordial years of Facebook, and a demographic curve that bends upward as the 45+ crowd becomes nearly 1/3 of the entire ecosystem. ChatGPT alone moves close to 6B monthly visits and now stands shoulder to shoulder with Instagram in the planetary rankings, as if conversation itself had quietly reclaimed the centre of the digital stage.

People are not walking away from social networks, at least not yet, but they are moving the part of their digital life that matters into a more intimate chamber.

The displacement has already happened, almost unnoticed, and this raises an uncomfortable question for the industry: if the social layer drifts away from the public feed and settles inside the intimacy of 1-to-1 dialogue, what remains of influence marketing when influence stops circulating through staged spectacle and begins to germinate in the solitude of private conversation?

The human calculator is dead: Why AI will Save revenue managers

The article argues that AI is ending the era of spreadsheet heavy “human calculators” in revenue management and freeing teams to focus on strategy. It explains how machine learning can clean and connect data, improve forecasting and price decisions, spot demand shifts faster than manual methods, and run tests at scale. Revenue managers keep control by setting goals, rules, and ethics, while AI handles routine analysis, alerts, and recommendations so decisions are quicker, more accurate, and tied to profit.

Make your hotel visible to AI: a checklist for ChatGPT

The article gives a simple checklist to make your hotel show up in ChatGPT and other AI searches. It says to write clear, specific content that answers traveler questions, keep listings, photos, and reviews complete and consistent, add structured data, and maintain clean metadata. It urges connecting live rates and availability so AI can see real prices and push guests to book, then measuring AI sourced visits and conversions to refine what works.

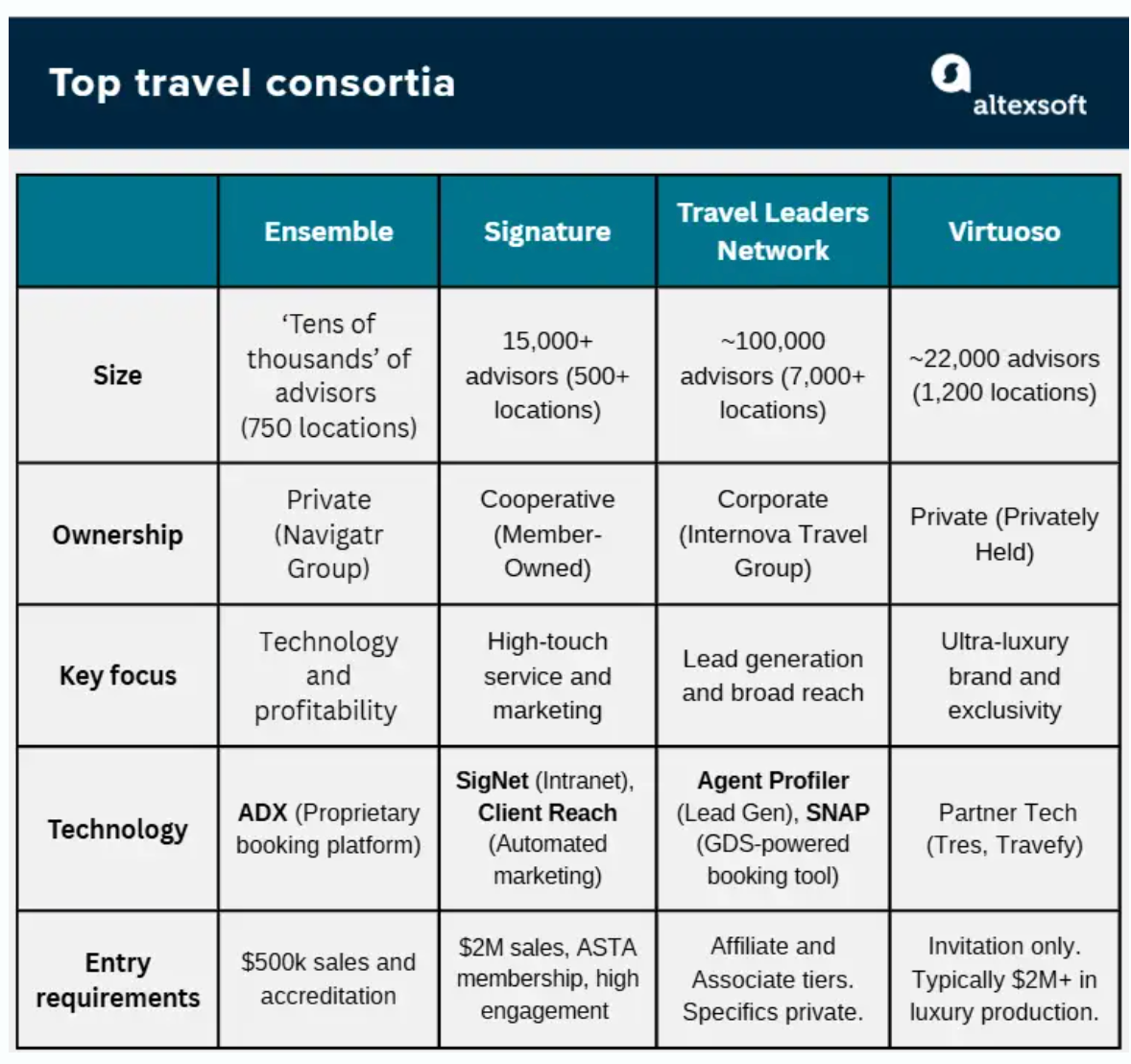

Travel Consortia: Full guide for agents and advisors

The article explains what travel consortia are and compares major networks such as Virtuoso, Signature, Ensemble, and Travel Leaders. It covers how consortia give agencies better rates, amenities, and marketing support through preferred supplier deals, shared technology, and training. It outlines typical requirements to join, costs and commissions, differences in focus like luxury versus broad market, and how agencies should choose based on their client base, supplier mix, and tech needs.

Per Day Pricing or Occupancy Based Pricing? The impact of connectivity on your revenue strategy (Part 1)

The article explains how a hotel’s pricing results depend not only on strategy but on the connectivity model carrying rates. It compares Per Day Pricing, which is simpler to manage, with Occupancy Based Pricing, which gives finer control by guest count, and says the right choice depends on how much complexity your team can handle. It ends by asking how hotels can combine OBP precision with PDP agility through better automation and integrations.

The true cost of hotel distribution

The article explains how the real cost of hotel distribution is more than OTA commissions, covering media spend, loyalty costs, staff time, tech fees, payment and chargeback costs, and cancellations. It recommends calculating contribution after all costs at the reservation level, comparing channels and segments on COPE and margin, and using clear dashboards to shift mix toward the most profitable business.

Follow on LinkedIn